How Different Generations Prefer to Communicate With Debt Collection Agencies

Start Making More Calls Today

Not sure which solution would be the best fit for your needs? We can work with you to find a solution that’s right for your business.

get a free quoteThe generation we belong to determines a lot about us: The clothes we wear, the music we listen to, the social media platforms we use, and what we’ll discuss here: the way we prefer to communicate.

We wanted to understand the associations between the generation a consumer belongs to and the way they communicate.

In debt collection, the ability to effectively reach and correspond with consumers is crucial to your overall success.

If you can understand how to best use the software at your disposal, it can improve your team’s engagement, productivity and outcomes.

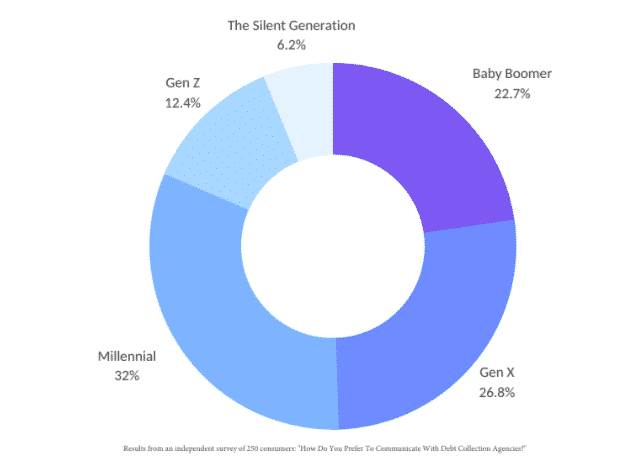

We conducted a survey of 258 consumers, spanning five generations, asking them how they wanted to receive notifications, make payments, and correspond.

Who Did We Survey?

How are the different generations classified?

The Silent Generation – 1945 and before

Baby Boomers – 1946-1964

Generation X – 1965-1976

Millennials or Gen Y – 1977-1995

Generation Z – 1996-now

Our survey respondents were not evenly split, and due to the sample size of the Silent Generation, we were unable to draw any significant conclusions.

We did, however, draw some significant conclusions about

The Channel They 💜

Across all channels, baby boomers rated snail mail the highest.

If you are notifying a baby boomer about their debt, we recommend you send a validation notice in the mail.

The Channel They Don’t 💜

Across all channels, baby boomers ranked texting the lowest.

If you are trying to reach a baby boomer, it’s best to avoid a text.

The Channel They 💜

Across all channels, Gen X rated email the highest.

We’d recommend using email in your first contact attempt to Gen X.

The Channel They Don’t 💜

Across all channels, Gen X ranked texting the lowest.

If you are trying to reach a Gen X-er, it’s best to avoid a text.

The Channel They 💜

Across all channels, Millennials rated email the highest.

We’d recommend using email in your first contact attempt to a millennial.

The Channel They Don’t 💜

Across all channels, Millennials ranked phone calls the lowest.

If you are trying to reach a Millennial, we recommend you don’t call them on the phone.

The Channel They 💜

Across all channels, Gen Z rated email the highest.

We’d recommend using email in your first contact attempt to a Gen Z-er.

The Channel They Don’t 💜

Across all channels, Gen Z ranked phone calls and snail mail the lowest (in a tie.)

Avoid calling a Gen Z-er or sending them something in the mail if you want to get in touch with them.

A Brief Note About Social Media

It seems that agencies have been dancing around the use of social media since Reg F gave the green light to use it.

Unsurprisingly, the pushback on this method of communication was swift. National headlines warned consumers that debt collection agencies would soon flood their DMs. A bill has already been introduced in New York State barring the use of social media, despite what Reg F says.

The results of our survey reflected all of this speculation – around 45 percent of consumers were explicit. They did not want to hear from collection agencies on social media.

However, around 25 percent of consumers said Facebook was okay.

And as for the 2 percent who said they preferred TikTok, we’re wondering if there are any agencies out there who are ready to make their TikTok dance debut.🙂

Experiment, Evaluate and Adapt

Our take on this data: Take it seriously, but be willing to adapt.

The most successful agencies will be the ones who are willing to experiment with different channels and adapt based on the results. So, you’ve taken in all of this data – what should you do right now?

- Start tracking your behaviors and outcomes on each channel, and be diligent. If you are ready to start diversifying your channel outreach, be ready to track the performance of each channel diligently. After a month, reevaluate how you are using each channel, and how it is helping or hurting your liquidation rates.

- Start with online presence, then make investments in new channels. If your online presence is nonexistent, or your reputation has gotten away from you, start there. If consumers are turned off by what they see when they Google you, adding in more channels may only escalate your troubles.

- Make your messaging consistent. Invest in training to keep your agents consistent across all channels. If a consumer is hearing from you on multiple channels, make sure your tone of voice and message stays the same.

As always, we’d love to learn more about how your agency is communicating, what you have trouble with, and how we can help. Book time to chat with us below if you’d like to learn more about how and why we build our communication solutions.

This information does not, and is not intended to, constitute legal advice; and may not be used as legal advice. Instead, all information is for general informational purposes only.

About The Author

Alex Villafranca

Alex is the CEO, co-founder and Head of Revenue at Arbeit, a better outbound communication software that makes businesses more profitable.