A Complete Guide to the CFPB’s Rules for Debt Collection, Reg F

Start Making More Calls Today

Not sure which solution would be the best fit for your needs? We can work with you to find a solution that’s right for your business.

get a free quoteThe CFPB’s Debt Collection rules, or Regulation F, is the new ruleset implemented under the CFPB to add clarity and guidelines in consumer communication for collection agencies. It went into effect on Nov. 30, 2021.

The rule gave clarity on topics like harassment, disclosures, and omnichannel communication. It includes safe harbors for voicemails, validation notices, and contact attempts.

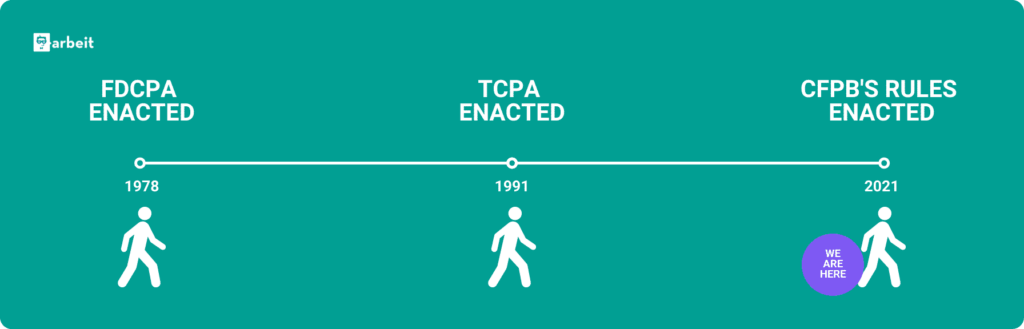

The debt collection landscape looks drastically different than it did in 1978, when the FDCPA was enacted. It’s changed dramatically since the TCPA was enacted, too. New technologies and generational preferences demanded a new set of guidelines to navigate these changes.

As an industry, we’ve had about a year to prepare, and yet adapting to the rule will be an ongoing effort.

We’ve spent the year having conversations with some of the smartest people we know on how this rule will impact day to day operations, and the industry as a whole.

If you’re wondering the same, you’re in the right place. In this blog, we’ll cover:

- The biggest changes brought by the CFPB’s debt collection rules

- A 10-step checklist for how to comply

- What your agents need to know (and don’t need to know) to do their job, and how to train them

Broken down by what we believe will impact operations, we’ll share expert insights on how to prepare and adapt for the future landscape of debt collection.

Keep reading to get started, or use the links below to skip to the topic you want to learn about:

- The Model Validation Notice

- The Limited Content Message

- New Rules for Contact Attempts (or 7-7-7)

- Rules for Omnichannel Outreach and Opt-In Consent

- How to Adapt Your Training to Reg F

The Model Validation Notice

Like much of Reg F, using the model validation notice is not a requirement.

With the creation of the model validation notice, the CFPB provided an opportunity to limit litigation as it relates to letters.

What is the Model Validation Notice?

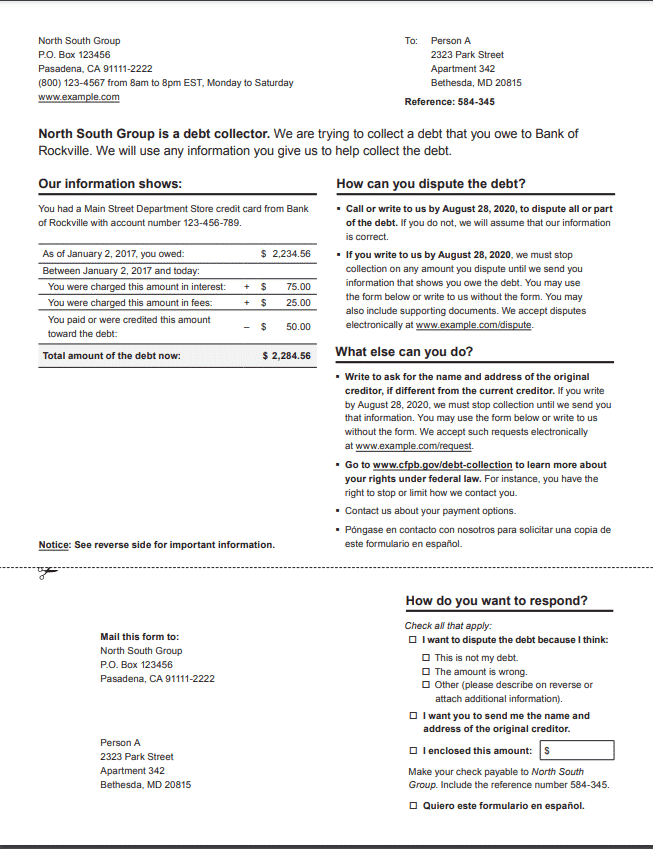

A debt collector must provide the consumer with validation information by:

- Sending a validation notice as the initial communication, or within 5 days of the initial communication, or;

- Providing the validation information orally in the initial communication itself.

The only exception is if the consumer has paid the debt prior to the expiration of the 5 day period. Then, the debt collector is not required to provide the validation information.

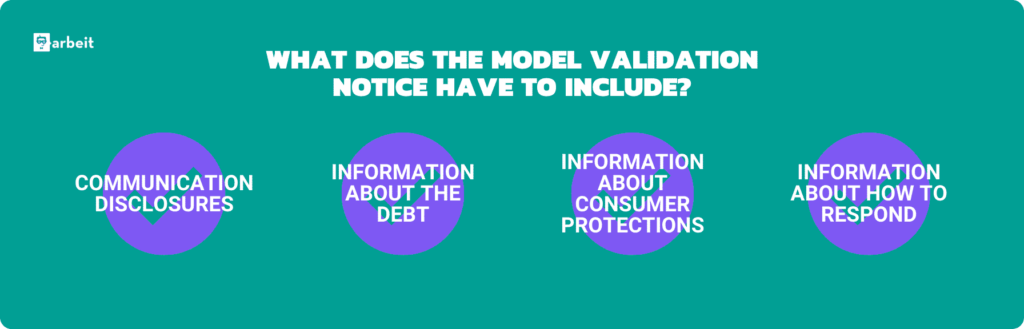

What Must the Model Validation Notice Include?

There are four main categories that the model validation notice provided by the CFPB must include.

CATEGORY ONE: Debt collection communication disclosures. In layman’s terms, this is what people in the accounts receivable management industry know as the mini-Miranda — the disclosure that needs to be made informing the consumer that they are being contacted by a debt collector.

CATEGORY TWO: Information about the debt. This includes some standard information, like the name and contact information for the collector and the current amount of the debt, and some new information — the itemization date.

CATEGORY THREE: Information about consumer protections.

CATEGORY FOUR: Information about how the consumer can respond to the letter.

Information about the Debt

There are nine pieces of information about the debt that will need to be part of all validation notices that are sent to consumers.

They are:

- The debt collector’s name and the mailing address at which the debt collector accepts disputes and requests for original-creditor information.

- The consumer’s name and mailing address.

- If the debt collector is collecting a debt related to a consumer financial product or service as defined in § 1006.2(f), the name of the creditor to whom the debt was owed on the itemization date.

- The account number, if any, associated with the debt on the itemization date, or a truncated version of that number.

- The name of the creditor to whom the debt currently is owed.

- The itemization date.

- The amount of the debt on the itemization date.

- An itemization of the current amount of the debt reflecting interest, fees, payments, and credits since the itemization date. A debt collector may disclose the itemization on a separate page provided in the same communication with a validation notice, if the debt collector includes on the validation notice, where the itemization would have appeared, a statement referring to that separate page.

- The current amount of the debt.

Itemization Date

Included in the validation information must be the itemization date, which will act as a reference to help consumers understand the timeline of when the debt was incurred.

Debt collectors have five options:

- The last statement date, which is the date of the last periodic statement or written account statement or invoice provided to the consumer by a creditor;

- The charge-off date, which is the date the debt was charged off;

- The last payment date, which is the date the last payment was applied to the debt;

- The transaction date, which is the date of the transaction that gave rise to the debt; or

- The judgment date, which is the date of a final court judgment that determines the amount of the debt owed by the consumer.

Information about Consumer Protections

There are six pieces of information about the debt that will need to be part of all validation notices that are sent to consumers.

They are:

- The specific date on which the collector considers to be the last day of the validation period. (Not just 30 days – the date on which the 30 days expires.)

- A statement that if the consumer disputes the debt in writing, on or before the aforementioned end of the validation period, the debt collector will cease collection of the debt or the disputed portion of the debt until they can provide validation of the debt to the consumer.

- A statement that unless the consumer notifies the debt collector disputing the validity of the debt, or portion of the debt on or before the aforementioned date, the debt collector will assume that debt is valid.

- A statement that if the consumer requests in writing, the name and address of the original creditor, the debt collector will stop collecting until information about the original creditor is provided.

- A statement that informs the consumer that additional information regarding their consumer protections is available at the bureau’s website, with a link to the CFPB’s website.

- If the notice is provided electronically, it must contain a statement explaining how the consumer can dispute the debt or request original creditor information electronically.

Should You Use the Model Validation Notice?

To answer this question, we turned to experts Tim Collins and Joann Needleman.

The first thing to note is that like much of Reg F, this is not a mandate, but rather a safe harbor.

With that, Tim Collins recommends asking yourself a few questions to determine whether or not you should take advantage of the safe harbor.

Question 1: Do you see a lot of lawsuits from the validation letter that you’re sending?

If you are presently experiencing a lot of litigation from your validation letters, this might indicate you are on a plaintiff’s radar and it might be a good idea to explore switching.

Question 2: Am I a large market participant?

The CFPB defines a large market participant as an organization who has made an average of $10 million per year over the last 3 years.

Note: Even if you don’t make this amount, it doesn’t exempt you from the CFPB’s rules.

This is simply another risk factor to consider, in that if you are a large market participant, that comes with regulatory exposure. The CFPB may come in and do examinations, audits, requests for information, etc.

Question 3: What would it cost for you to make the change?

Some costs that come with switching may include:

- Training

- Partnering with a letter vendor

- Updating systems

In addition, make sure that your creditors can provide you with all the necessary information.

If for some reason you have to choose between using the CFPB’s notice, but not sending as many notices due to lack of access to information, conduct a cost benefit analysis.

Joann’s piece of advice regarding the model validation notice was simple. Using the model validation notice will be the first indication that you are complying with Reg F – or not.

It will be a signal of your compliance efforts to litigators and consumers alike.

It comes down to risk tolerance – much like the Limited Content Message, which we’ll discuss next.

The Limited Content Message

What is the Limited Content Message?

One of the most anticipated elements of the new rule was the Limited Content Message. The message was designed to be a safe harbor for agencies who want to leave voicemails, but risked third-party disclosure in doing so. The CFPB addressed this by outlining a voicemail that will not be considered a communication – the Limited Content Message.

To learn about the Limited Content Message, we turned to our friend and compliance expert John Bedard.

The Limited Content Message (or LCM) must include certain information, can include other information, and may not include anything else.

It Must Include:

- Business name of the debt collector (which cannot indicate that the company is in the debt collection business.)

- A request that the consumer reply to the message

- The name of one or more people the consumer can contact to reply

- The telephone number(s) the consumer can use to reply

It Can Include:

- A salutation like “Hello”

- The date and time of the voicemail

- Suggested dates that the consumer can reply

- A statement that if the consumer replies, the consumer can speak to any of the representatives of the company

Under the FDCPA, a “communication” is defined as a conversation between a consumer and a collector that conveys information about a debt. Because the Limited Content Message omits all information about a consumer’s debt, it technically cannot be considered a communication.

This means that collectors will not be required to make the disclosures (the Mini Miranda) that come with a “communication,” and the CFPB allows collectors to make contact with a consumer, without it being a communication.

Should You Use the Limited Content Message?

Our expert Tim Collins returned to recommend asking yourself two main questions to determine whether or not you should take advantage of the safe harbor.

Question 1: Do you see a lot of litigation as it relates to the messages you’re using?

If you’re seeing a lot of that, or anticipate litigation as plaintiff lawyers adjust their tactics, maybe the limited content message is a good place start.

Question 2: What is the cost to switch to using the Limited Content Message?

If you’re going to change your messaging, keep in mind it will come with some significant costs:

- Agent training

- System upgrades

- Audit programs

- Policies and procedures

Another cost to consider is the cost to rebrand your agency. The limited content message does not allow you to disclose you are a debt collection agency, and many agencies have names that in some way disclose that information.

A rebrand comes with its own costs, for example: licensing, a website, your domain name, etc.

Conduct your own studies

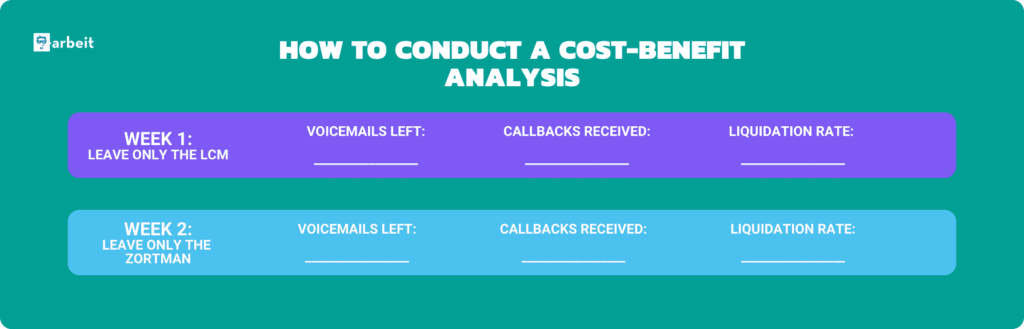

First, conduct a cost-benefit analysis based on the above question.

For one week, don’t leave any messages to consumers. The next week, use the limited content message. The next week, use the Zortman message. See what your callbacks are and go from there.

What it really comes down to, explains Tim, is risk. Not regulatory risk – the CPFB has created this as a safe harbor – but litigation risk.

If you experience a high volume of litigation risk, the limited content message offers a solution. If not, it might be best to continue with your current strategy and adjust if needed.

New Rules for Contact Attempts

According to the rule, a debt collector is presumed to comply with the rule against harassing, oppressive and abusive conduct if they:

- Do not attempt more than 7 telephone calls in 7 consecutive days to the same person regarding the same debt

- Do not place another call within 7 days of a conversation

Voicemails count. Electronic communication does not.

According to the rule, it’s up to the consumer to prove harassing, oppressive or abusive conduct by a debt collector. There are a few key pieces of evidence that might be used by a consumer:

- Content of prior communications – i.e., a consumer requests a cease and desist during a conversation, but a debt collector continues to call

- Obscene or profane language

- Calling at an inconvenient time

What does inconvenient mean?

- Before 8 a.m. or after 9 p.m. at the consumer’s location (based on area code and zip code)

- When a collector receives account notes from a client that contains information about the times or places that might be inconvenient to a consumer, that collector is going to be charged with ‘should know’ what is inconvenient

There are four exceptions to the 7-7-7 rule, or situations where a collector may “violate” the rules:

- The debt collector is placing a call to notify the consumer of a required legal disclosure – i.e., the law requires the communication

- If the call directly relates to active litigation related to the debt (a court-ordered communication)

- In response to a consumer’s request for information

- To inform the consumer on how to avoid what might be imminent negative consequences that are not the result of a debt collector’s behavior (i.e. foreclosure)

Rules for Omnichannel Outreach

With these rules, the CFPB is encouraging agencies to invest in new technology to modernize their communication.

Building out consumer-centric collections means taking consumer preference into consideration. Texting is now a preferred method for the majority of millennials.

“(In Regulation F)… there is no grace period to change a consumer’s requested change in communication method,” says Leslie Bender of Clark Hill Law.

She further elaborates that if a communication change request is made and is not honored due to support processing time, that can technically be applicable as a violation.

It is essential that changed communication requests are prioritized and accommodated immediately to avoid noncompliance.

To start using omnichannel outreach, however, you must first have opt-in consent.

In general, your goal should be to capture consent ASAP. Here are a few ways:

Encouraging consumers via your website to text or email you first. Then, you can reply with a standard message that confirms whether they want to opt-in. When the consumer texts you first, carriers can see that a relationship is present.

Discuss broader Terms of Service when taking on new clients. You might include something along the lines of “XYZ Agency can use any digital communication method that is acceptable to the consumer,” for example.

Encourage your collectors to ask questions like “can I get an email address?” and “is this still a good number to contact you at?” during their talk-off at the end of each call. If the consumer provides their email and/or says yes, this may count as an opt-in.

If you start being proactive about capturing consent now, you’ll give your agency a massive competitive advantage to leading consumer-centric conversations.

In the words of our product manager Kaitlyn Filippi, “more work now, less work later.”

Training Collectors for Reg F

The myth of Reg F is that once Nov. 30 arrives, anything you might have done to prepare will be set in stone, it’s too late to do anything else, and you’re either ready, or you’re not.

The reality of Reg F is that changes to your systems, policies and training should be ongoing. No matter where you are in your preparation, it’s never too late to start, and it will require constant adaptation – as long as the rule is around.

Debt collection training expert Greg Ruffino explains how looking at the entire picture of Reg F can easily and quickly become overwhelming for collectors.

Although there is a huge amount of effort to prepare for Reg F at the highest level of debt collection organizations – IT, management, operations, etc. – Greg explains how collectors are still on the front lines as the revenue generators.

So what is it that’s most important for them to understand?

Greg shared a visual of what Williams & Fudge is basing their own strategy around.

On the left is what he is training his team on, and what he believes will be most important for day to day staff to be familiar with.

On the right are components of Reg F that he believes will not affect his staff on a day to day basis, or can be handled or automated by management staff.

Greg goes on to explain that even within the confines of the left side of his list, he is still providing ample resources for his collectors to use.

For example, he is not asking his collectors to memorize the Limited Content Message.

Instead, his systems will automatically present the message to them when a button is pushed.

Another example is that the model validation notice will be available for his collectors to pull on any account. This will make information critical to Reg F compliance, like “last statement date,” available for them to share with the consumer if needed.

How often should you train collectors to prepare? The key to this question is to know your staff.

Greg explains that the specifics of the rule were not introduced to his team until 15 days before, but each agency will be different.

Ask yourself:

- How much preparation is your staff used to being given?

- What format or cadence of training does your staff prefer?

- How much can your staff absorb at one time?

Greg emphasizes that, whatever degree of Reg F you decide to share with collectors, do it over video or in person.

Avoid sharing the information over email or in a document for them to review on their own, especially at first. Face to face conversations as soon as possible are key.

This is only the beginning.

With the right mindset and the right training, we firmly believe that Reg F can be a positive shift for the industry and the future of debt collection.

What seems to be the theme with these new rules? Make less, more meaningful contact with consumers.

We at Arbeit are advocates for more pleasant conversations. We believe that, if employed responsibly, the final debt collection rules make room for much more pleasant conversations.

Consumer preference can now be taken into consideration to it’s fullest extent. If a consumer wants to handle their debt via their Facebook messages, there is now space for that.

There are plenty of options to get in touch with a consumer. But this doesn’t necessarily mean agencies should now flood every single one of a consumer’s communication channels with messages about their debt – no one would respond well to that, and it would certainly not elicit a pleasant conversation.

As we continue to process what this rule’s implementation will look like, and adopt our product’s accordingly, we will always advocate for pleasant conversations. These will most likely stem from understanding the consumer on the other end of the line to the best of your ability and now having the freedom to reach them how they prefer to be reached.

Note: This blog is not intended to be legal advice and may not be used as legal advice. Legal advice must be tailored to the specific circumstances of each case. Every effort has been made to ensure this information is up-to-date. It is not intended to be a full and exhaustive explanation of the law in any area and should never be used to replace the advice of your own legal counsel.

About The Author

Alex Villafranca

Alex is the CEO, co-founder and Head of Revenue at Arbeit, a better outbound communication software that makes businesses more profitable.