How Are Debt Collection Agencies Using Email in 2022?

Start Making More Calls Today

Not sure which solution would be the best fit for your needs? We can work with you to find a solution that’s right for your business.

get a free quoteIf you’re here because you’re curious about using email for debt collection, we’re happy to tell you that you’re in the right place.

Thanks to Reg F, agencies are embracing new channels of communication for the first time. Email is one of these channels, and it turns out that consumers really like communicating over email.

Here, we’ll cover:

- How consumers prefer to use email, based on the results of our independent consumer preference survey

- How industry though leaders are currently using email

Now is a great time to start imagining ways to incorporate email into your strategy, and this guide is a great place to start!

How Do Consumers Want To Use Email?

In January 2022, we asked 250 consumers how they prefer to communicate with debt collection agencies.

Many of the responses indicated that email was one of the best, if not the best, way to reach and correspond with consumers.

It may not come as a surprise, if you examine your own preferences. When you, for example, file your taxes, or make a return, it’s nice to use email as a place to file and track important documents.

But we also recognize that debt collection can bring up negative stereotypes and stigmas.

Truth be told, no one wants to communicate with a debt collection agency.

But even though our preferences for debt collection might be different from our normal preferences, patterns show that debt collection communication and technology has evolved to keep up with what’s convenient and feels the least intrusive – i.e., email.

A few questions from our survey demonstrate this perfectly.

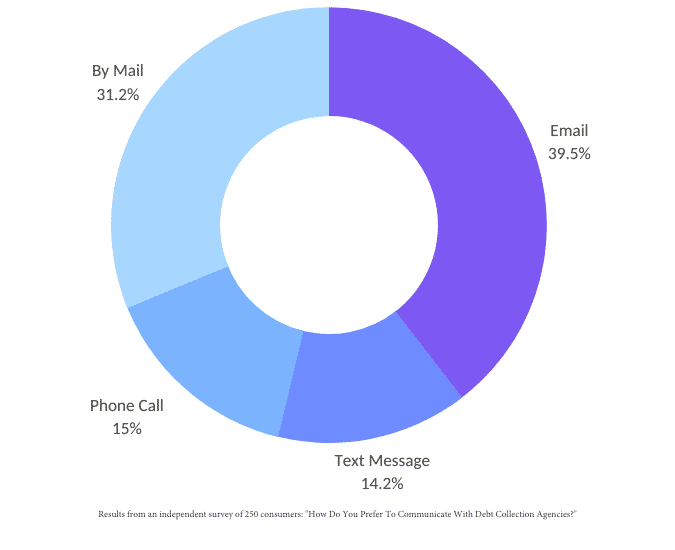

"A Debt Collection Agency Is Contacting You For The First Time. How Would You Prefer They Contact You?"

In our survey, we asked consumers what they wanted their first interaction with a debt collection agency to look like.

By a small margin, email was most preferred – second to physical mail, and well above phone calls or text messages.

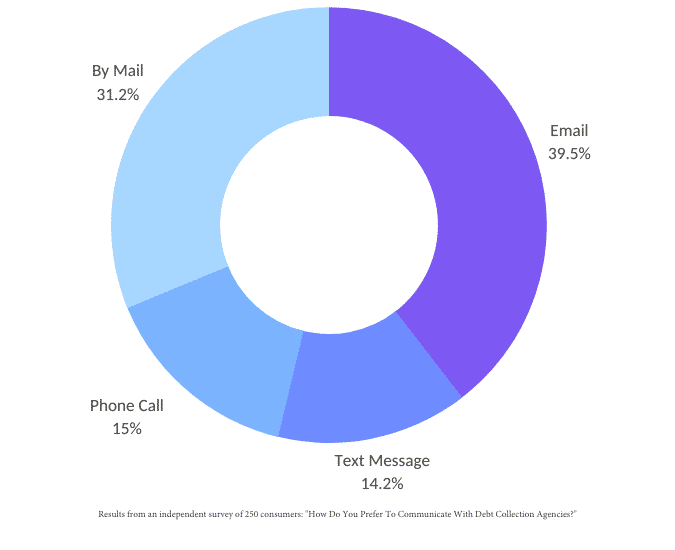

"Once A Conversation Has Been Initiated, How Would You Prefer To Correspond With A Debt Collection Agency?"

We also wanted to understand what it would look like for a consumer to correspond with a debt collection agency on their terms – for example, to negotiate a payment plan or validate their debt.

By far, email was the most preferred method to achieve this.

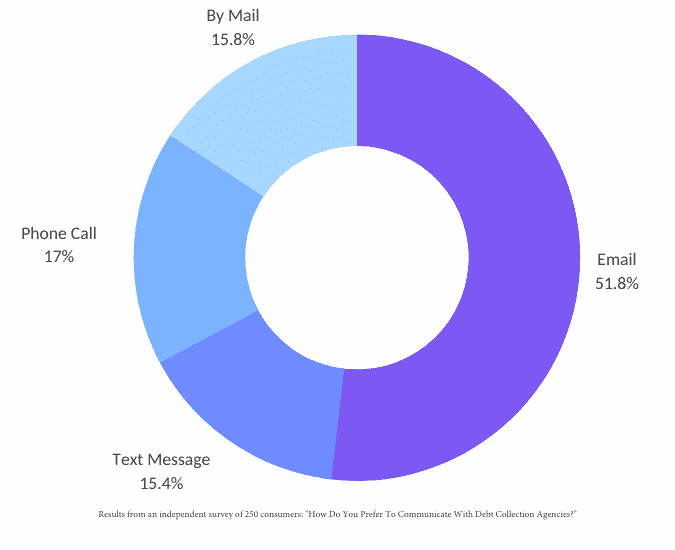

"How Favorably Would You Respond To A Debt Collection Agency Contacting You On A Given Channel?

Finally, we asked consumers to rank, on a scale of 1-10, how favorably they would respond to a communication on four different channels: Email, Text Message, Phone Call and Social Media.

Email was the most preferred across these channels.

How Are Debt Collection Agencies Using Email?

Once we understood how consumers want to use email, we turned to the thought leaders inside our industry to understand how they were using email to achieve their bottom lines – profit and employee engagement.

Technique One: Offering Email As A Preferred Option

“DRS is definitely committed to reaching consumers in the manner they prefer! With recent additions to collection laws regarding consumer contact methods, we now have numerous options available – including email.

This makes it more convenient for consumers to communicate in the manner that is easiest for them. Additionally, many phones now have the option to simply not answer unknown callers (us). So having email as a contact method isn’t just a ‘nice option’, it’s practically a necessity.”

Debt Recovery Solutions of Ohio is a leader in employee engagement and reputation, so we wanted to understand how they use email to achieve both internal productivity and consumer satisfaction.

Client Care Manager Kimberly Atwell explained how offering email as an option allows a level of convenience that phone calls often can’t achieve.

It’s an especially crucial option since many phones offer the option to silence unknown callers altogether.

Technique Two: Automating Scans for Email Compliance

“Williams and Fudge has been using collector self-generated emails to consumers (with consent provided of course) for over ten years now. Our collectors are permitted to both capture consumer consent and initiate and exchange email correspondence with those they are working with in their collection efforts.

We use an in-house built compliance email tool that scans any outbound email to the consumer for non-approved words and phrases to ensure we are sending a compliant email. This tool has been extremely beneficial in our outreach efforts and collection success.

The consumer often finds this option to be very convenient and easier for them and they tend to have no problem in giving consent and communicating this way.”

Williams & Fudge has been a leader in embracing new forms of technology for years, and refining these tools alongside regulations.

Greg Ruffino shared how automating the process of scanning an email for compliance has proved to be extremely useful for their team, keeping them productive and successful.

And of course, at the same time, consumers tend to prefer this method and are typically prone to provide consent for email correspondence.

Technique Three: Using Email To Negotiate, Reach Settlements, And More

“We find that email is the preferred communication channel for many of our debtors. We email invoices, debt validation letters and negotiate payment plans and settlements all through emails.”

Andalman & Flynn is a team of collection attorneys, so they had a great perspective on the compliance aspects of new channels of communication.

Jana Arkoian, Paralegal and Collections Manager, shared that using email for the same types of communication you could achieve via physical mail or phone calls works well for them, and is preferred by consumers.

Technique Four: Adopting a Compliance First Mindset

“If words like Regulation and Compliance were not an issue then I believe all agencies would be heavily using email, but these are the things that have held back many small to medium sized agencies back.

Consumers want to communicate through this channel and it should be made easier for agencies to do so. Currently we are more reactive than proactive with email communication, however we are hoping that 2022 brings us more compliant opportunities in this area.”

It’s taken years for regulators to clarify what is, and is not, permitted when it comes to new channels of communication.

One of the most complimented agencies we know of – American Profit Recovery – achieves their reputation by paying close attention to what consumers prefer, while also operating within high standards of compliance.

Because of these high standards, they have not fully embraced email quite yet, but plan to. It only goes to show that channels like the phone and physical mail are still effective at achieving happiness on both sides.

Start To Imagine Your Collections Strategy With Email In Mind

It seems like it’s rare that consumers, regulators and debt collection agencies are in agreement on anything, but email seems to be preferred by all parties.

We believe it’s an important time to start imagining how email can fit into your strategy so that you can achieve higher rates of consumer satisfaction, employee engagement and growth.

About The Author

Alex Villafranca

Alex is the CEO, co-founder and Head of Revenue at Arbeit, a better outbound communication software that makes businesses more profitable.